What kind of security system is necessary for banking?

What's New?

All news

How to Choose the Right Surveillance Cameras for Retail: Zone-Based Guidance with DORI Standards in Mind

How to Choose the Right Surveillance Cameras for Retail: Zone-Based Guidance with DORI Standards in Mind

Welcoming Our New Platinum Partner: BİSAVUNMA GÜVENLİK VE RADAR SİSTEMLERİ SANAYİ TİCARET LİMİTED ŞİRKETİ

Welcoming Our New Platinum Partner: BİSAVUNMA GÜVENLİK VE RADAR SİSTEMLERİ SANAYİ TİCARET LİMİTED ŞİRKETİ

How TRASSIR’s PRO Dual Light Cameras Help You Work Faster and Smarter

How TRASSIR’s PRO Dual Light Cameras Help You Work Faster and Smarter

No More Blind Spots: How TRASSIR Reduces Losses and Investigation Time in Warehouses

No More Blind Spots: How TRASSIR Reduces Losses and Investigation Time in Warehouses

Welcoming Our New Gold Partner: DG Bilgisayar ve Yazılım Destek Hizmetleri

Welcoming Our New Gold Partner: DG Bilgisayar ve Yazılım Destek Hizmetleri

Beyond the Perimeter: How TRASSIR Protects What’s Outside Your Factory Walls

Beyond the Perimeter: How TRASSIR Protects What’s Outside Your Factory Walls

Welcoming Our New Platinum Partner: KARE BİLGİSAYAR SANAYİ VE TİCARET ANONİM ŞİRKETİ

Welcoming Our New Platinum Partner: KARE BİLGİSAYAR SANAYİ VE TİCARET ANONİM ŞİRKETİ

TRASSIR Launches New Cameras with Dual Illumination to Reduce Incident Investigation Time

TRASSIR Launches New Cameras with Dual Illumination to Reduce Incident Investigation Time

Welcoming Our New Platinum Partner: ZNA TEKNOLOJI

Welcoming Our New Platinum Partner: ZNA TEKNOLOJI

Keeping Things Moving: How TRASSIR Helps Logistics Run Smoothly

Keeping Things Moving: How TRASSIR Helps Logistics Run Smoothly

Welcoming Our New Platinum Partner: LION TECHNOLOGY

Welcoming Our New Platinum Partner: LION TECHNOLOGY

New Success Story: Industrial-Grade Security at Mirbey Plastik

New Success Story: Industrial-Grade Security at Mirbey Plastik

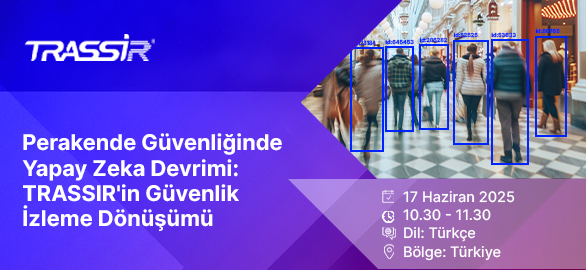

AI-Powered Insights for Retail Security in Türkiye: How TRASSIR’s intelligent video analytics transform retail surveillance

AI-Powered Insights for Retail Security in Türkiye: How TRASSIR’s intelligent video analytics transform retail surveillance

Our First Step into Global Retail: Highlights from Retail Days 2025

Our First Step into Global Retail: Highlights from Retail Days 2025

Transforming Campus Safety: TRASSIR’s Proactive Approach to Protection

Transforming Campus Safety: TRASSIR’s Proactive Approach to Protection

Smarter Surveillance, Smoother Manufacturing

Smarter Surveillance, Smoother Manufacturing

TRASSIR Solutions to Be Featured at Securex South Africa 2025 by neaMetrics

TRASSIR Solutions to Be Featured at Securex South Africa 2025 by neaMetrics

Success Story: Smarter Access Control at Hilton Istanbul Bomonti

Success Story: Smarter Access Control at Hilton Istanbul Bomonti

Retail Losses Start at the Checkout: Here’s How to Fight Back

Retail Losses Start at the Checkout: Here’s How to Fight Back

Zigana Energy Secures Solar Fields with TRASSIR’s AI-Powered Surveillance

Zigana Energy Secures Solar Fields with TRASSIR’s AI-Powered Surveillance

Try TRASSIR For Your Business

Learn more about how TRASSIR analytic modules work! Demo mode is an opportunity to see for yourself how the system works, and also check the interface and test all the functions.Success!

We will contact you as soon as possible